Noida, May 21, 2024: RateGain Travel Technologies Limited (NSE: RATEGAIN), a global provider of AI-powered SaaS solutions for the hospitality and travel industry, today announced its financial results for Q4 & FY24 ending on March 31, 2024, reporting another strong set of results with record revenue and significant margin expansion with growing traction across marquee clients and operational excellence.

The company’s ability to innovate and address the unique challenges faced by the industry, helped in doubling the new contract wins in FY2024 to INR 2,847.8 Mn with the Annual Recurring Revenue at INR 10,232.6 Mn.

As demand continues to stay resilient in an uncertain global environment and AI changes customer behaviour, RateGain’s AI-led products are witnessing accelerated adoption across the industry to provide accurate insights at scale, find the right audience and, acquire them to drive incremental revenue and improve their ROI. To that end, RateGain continues to leverage its proven M&A playbook to identify complementary capabilities that can help its customers in unlocking more revenue and drive synergies by leveraging its global presence.

RateGain closed out the year on a strong note delivering an operating revenue growth of 69.3% YoY to INR 9,570.3 Mn and improvement in operating margins to 19.8% for FY24, up from 15.0% in the same period last year: with a balanced approach focused on sustainable growth across segments and operating leverage playing out. The company’s Profit after Tax grew by 2.1x to INR 1,453.9 Mn in FY24 as compared to INR 684.0 Mn in the previous year.

As the industry looks to consume more data and insights to drive efficiencies across teams to take faster decisions, technology spends are expected to increase to bring in easy to use innovative solutions that leverage AI to help simplify guest acquisition, improving retention and maximising revenue. RateGain is well positioned to capture this opportunity and has a healthy pipeline of INR 4,862.3 Mn.

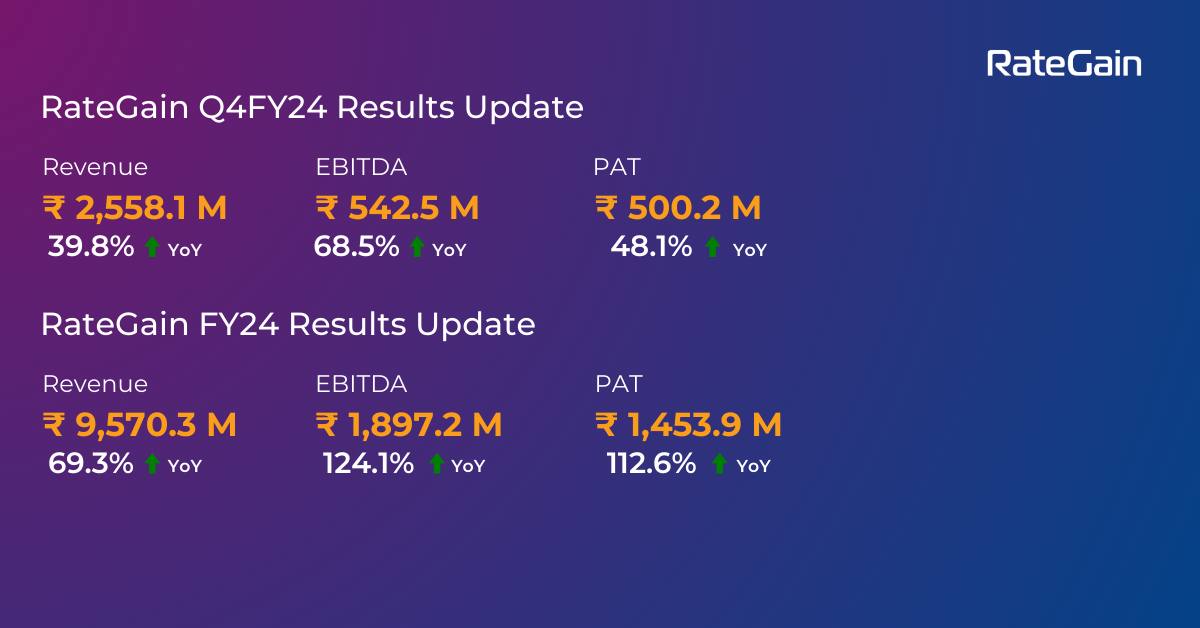

For Q4FY24, the quarter ending March 31, 2024, compared to the corresponding quarter last year the company reported:

- Operating Revenue of INR 2,558.1 Mn v/s INR 1,829.3 Mn (+ 39.8%)

- Total Revenue at INR 2,768.6 Mn v/s INR 1,877.3 Mn (+ 47.5% YoY)

- EBITDA at INR 542.5 Mn v/s INR 322.1 Mn (+ 68.5% YoY)

- PAT at INR 500.2 Mn v/s INR 337.9 Mn (+ 48.1% YoY)

- EBITDA margin at 21.2% v/s 17.6%

- PAT margin at 19.6% v/s 18.5%

For FY24 compared to the same period last year, the company reported:

- Operating Revenue of INR 9,570.3 Mn v/s INR 5,651.3 Mn (+ 69.3%)

- Total Revenue at INR 9,985.9 Mn v/s INR 5,850.6 Mn (+ 70.7% YoY)

- EBITDA at INR 1,897.2 Mn v/s INR 846.5 Mn (+ 124.1% YoY)

- PAT at INR 1,453.9 Mn v/s PAT of INR 684.0 Mn (+ 112.6% YoY)

- EBITDA margin at 19.8% v/s 15.0%

- PAT margin at 15.2% v/s 12.1%

The company continues to outperform on key operating metrics when benchmarked against other SaaS companies, the LTV to CAC stands at 14.1x for FY24 and the Revenue per Employee improved to INR 13.3 Mn highlighting healthy productivity. The company witnessed improved revenue diversification with well balanced growth across key geographies and top 10 customers contributing to 28.3% of total revenue in FY24, down from 32.2% in the previous year.

Sharing his views on what helped in driving the performance this quarter, Bhanu Chopra, Founder and Chairman, RateGain Travel Technologies, said, “FY24 was a transformative year for RateGain, and it would not have been possible without the combined effort of our global teams to continuously deliver value to our clients.

The need for reliable insights, easy to use and intuitive products will only increase as the industry starts looking at more data to make better decisions. Our investments over the past year in tech and talent to scale our AI-led products will enable us to be in a great position to help our customers to unlock new revenue every day.

As we set sight on bigger goals, our culture of innovation and focus on operational excellence will be critical to drive future growth.”

Commenting on the key metrics, Tanmaya Das, Chief Financial Officer, RateGain Travel Technologies, said, “We continue to see robust revenue growth coupled with strong margin expansion, clearly demonstrating the value we are delivering to our customers. The key to this has been our proven ability to turn around our acquisitions validated by Adara’s exceptional performance.

The company continues to witness significant improvement across key operating metrics including customer retention and revenue diversification.

With focused execution we witnessed doubling of our contract wins in the past year powered by healthy growth from key markets and a strong demand for our products in emerging markets positioning us well for future growth opportunities.”

The company continues to add to its headcount with a global team of 770 and has reduced its attrition rate to an all-time low of 11.2%. RateGain continues to focus on its DE&I initiatives and adapting practices in line with our goal of building a sustainable workplace environment focused on employee development, inclusivity and diversity.

About RateGain

RateGain Travel Technologies Limited is a global provider of AI-powered SaaS solutions for travel and hospitality that works with 3,200+ customers and 700+ partners in 100+ countries helping them accelerate revenue generation through acquisition, retention, and wallet share expansion.

RateGain today is one of the world’s largest processors of electronic transactions, price points, and travel intent data helping revenue management, distribution and marketing teams across hotels, airlines, meta-search companies, package providers, car rentals, travel management companies, cruises and ferries drive better outcomes for their business. Founded in 2004 and headquartered in India, today RateGain works with 26 of the Top 30 Hotel Chains, 25 of the Top 30 Online Travel Agents, 4 of the Top 5 Airlines, and all the top car rentals, including 16 Global Fortune 500 companies in unlocking new revenue every day. For more information, please visit www.rategain.com.

Forward-looking Statements

Certain statements in this release are forward-looking statements, which involve some risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from those in such forward-looking statements. All statements, other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to the statements containing the words ‘planned,’ ‘expects,’ ‘believes’, ‘strategy,’ ‘opportunity,’ ‘anticipates,’ ‘hopes’, or other similar words. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding impact of pending regulatory proceedings, fluctuations in earnings, our ability to manage growth, intense competition in IT services, data services, and consulting services including those factors which may affect our cost advantage, wage increases in India, customer acceptance of our services, products and fee structures, our ability to attract and retain highly skilled professionals, our ability to integrate acquired assets in a cost-effective and timely manner, time and cost overruns on fixed-price, fixed-timeframe contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, the success of our brand development efforts, liability for damages.

Media Contact

Ankit Chaturvedi

ankit.chaturvedi@rategain.com

Global Head-Marketing

Malaysia

Malaysia

UAE

UAE

Indonesia

Indonesia

Thailand

Thailand

Deutsch

Deutsch Português

Português Italiano

Italiano Espanol

Espanol čeština

čeština ไทย

ไทย العربية

العربية Français

Français