New Delhi, 13th February 2026: RateGain Travel Technologies Limited (NSE: RATEGAIN), a global provider of AI-powered technology solutions for the hospitality and travel industry, today announced its financial results for Q3FY2026 ended December 31, 2025, reporting revenue growth driven by strong performance across its DaaS and MarTech businesses. This quarter also marks the first full consolidation of Sojern’s financial performance following the completion of the acquisition in November 2025.

RateGain’s unified AI-powered travel technology platform continued to gain strong validation during the quarter across multiple strategic regions. By bringing together marketing, distribution, and data capabilities within a single, connected environment, the company is enabling travel and hospitality enterprises to operate with greater precision, agility, and measurable growth impact. With Sojern now part of this ecosystem, RateGain has significantly expanded its global marketing scale, deepening its media activation and traveler intelligence capabilities to shape demand creation worldwide.

During the quarter, RateGain expanded Sojern’s engagement with major clients including the rollout of an enhanced AI Concierge solution with Red Roof. This reinforces RateGain’s commitment to delivering AI-driven customer engagement tools that drive direct revenue and enhances guest experiences across hospitality segments.

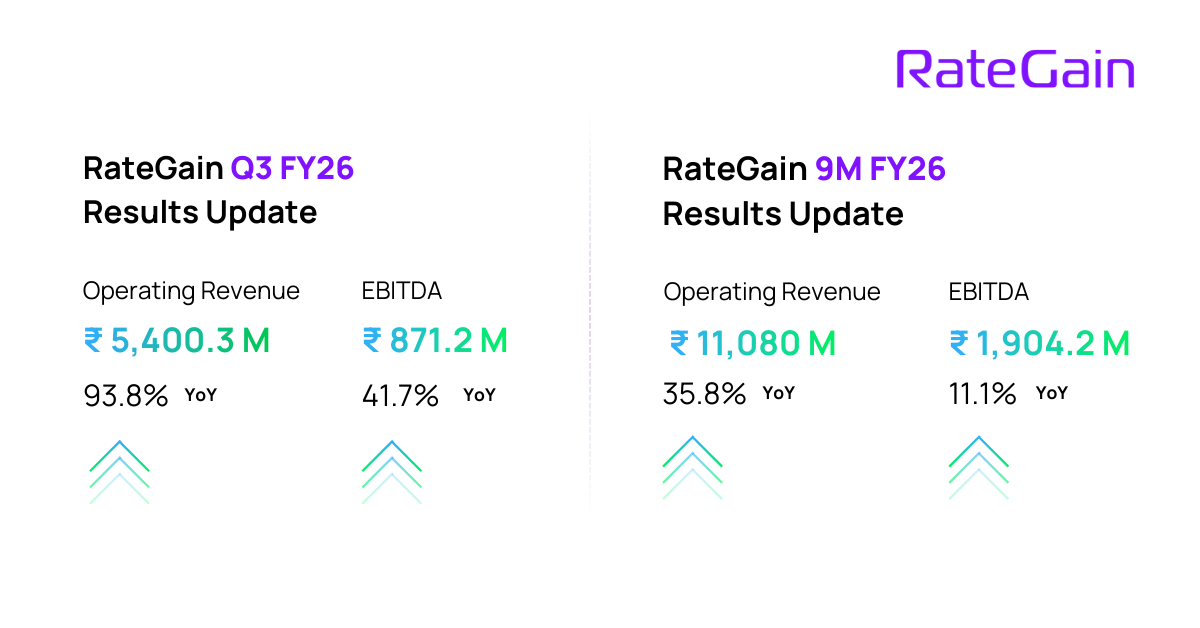

RateGain reported highest ever operating revenue of INR 5,400.3 Mn in Q3FY2026, growing 93.8% year-on-year, and delivered an operating margin of 16.1%. PAT stood at INR 264.5 Mn, impacted by the increase in amortization cost related to the recent acquisition of Sojern and one-time exceptional expense incurred related to the acquisition costs. Adjusted for one-time exceptional expense the PAT stands at INR 610.7 Mn, an increase of 8.0% over the same period last year.

Our Cash Flow from Operations stood at INR 1,517.4 Mn on a YTD basis, reflecting the strength of the business model as the company generates healthy cash flows every quarter. Basis the strong organic cash flow generation, RateGain has repaid nearly 20.2% of its acquisition-related debt, amounting to USD 25.25 Mn. Out of this USD 19.0 Mn was prepaid along with the quarterly installment of USD 6.25.

For Q3 FY26, compared to the same quarter last year, the company reported:

- Operating Revenue of INR 5,400.3 Mn v/s INR 2,787.1 Mn (+ 93.8% YoY)

- Total Revenue at INR 5,565.9 Mn v/s INR 2,990.4 Mn (+ 86.1% YoY)

- EBITDA at INR 871.2 Mn v/s INR 614.7 Mn (+ 41.7% YoY)

- PAT at INR 264.5 Mn v/s INR 565.4 Mn (- 53.2% YoY)

- EBITDA margin at 16.1% v/s 22.1%

- PAT margin at 4.9% v/s 20.3%

For 9M FY26, compared to the same quarter last year, the company reported:

- Operating Revenue of INR 11,080.0 Mn v/s INR 8,159.8 Mn (+ 35.8% YoY)

- Total Revenue of INR 11,667.7 Mn v/s INR 8,719.0 Mn (+ 33.8% YoY)

- EBITDA at INR 1,904.2 Mn v/s INR 1,714.7 Mn (+ 11.1% YoY)

- PAT at INR 1,244.0 Mn v/s INR 1,541.2 Mn (- 19.3% YoY)

- EBITDA margin at 17.2% v/s 21.0%

- PAT margin at 11.2% v/s 18.9%

Bhanu Chopra, Founder and Managing Director, RateGain, said, “Building on the quarter’s financial performance, it’s worth noting that the completion of the Sojern acquisition in November 2025 marked one of the largest strategic moves in RateGain’s history, bringing together complementary AI-powered marketing, distribution, and revenue technologies and creating a combined platform serving over 13,000 travel brands globally. This positions RateGain as a category-leading AI-driven travel tech provider with unparalleled customer reach and product breadth.”

Rohan Mittal, Chief Financial Officer, RateGain, said, “We delivered healthy revenue momentum and strong free cash flow generation during the quarter, underpinned by disciplined operating execution. The integration of Sojern is progressing well across cost synergies and organizational alignment, with early benefits beginning to reflect in operating leverage. We are also advancing toward a more unified go-to-market structure to drive scalable growth.

Supported by a strong balance sheet, we remain well positioned to invest in growth while maintaining a focus on sustainable profitability.”

As RateGain continues to scale its operations, strengthening organizational depth remains a key priority. The company is now a 1,250+ strong global team and, to support integration and growth, made key leadership appointments across its People & Culture function. Alongside this, RateGain continues to embed AI into internal workflows and decision-making processes to build a future-ready, high-performance organization. The company was also certified as a Great Place to Work® for the seventh consecutive year and recognized among India’s Best Workplaces. Further strengthening brand recognition, RateGain was named Emerging Company of the Year at the ET Corporate Excellence Awards.

About RateGain

RateGain Travel Technologies Limited is a global provider of AI-powered SaaS solutions for travel and hospitality that works with 13,000+ customers and 700+ partners in 160+ countries helping them accelerate revenue generation through acquisition, retention, and wallet share expansion.

RateGain today is one of the world’s largest processors of electronic transactions, price points, and travel intent data helping revenue management, distribution and marketing teams across hotels, airlines, meta-search companies, package providers, car rentals, travel management companies, cruises and ferries drive better outcomes for their business.

Founded in 2004 and headquartered in India, today RateGain works with 33 of the Top 40 Hotel Chains, 4 of the Top 5 Airlines, 7 of the Top 10 Car Rentals, and all leading OTAs and metasearch websites, including 25 Global Fortune 500 companies, in unlocking new revenue every day.

PRESS CONTACTS:

Aastha Khurana (RateGain: media@rategain.com

Deutsch

Deutsch Português

Português Italiano

Italiano Espanol

Espanol čeština

čeština ไทย

ไทย Français

Français